The Australian Securities Exchange (ASX) closed lower on Friday, led by declines in the technology and banking sectors, while gains in mining stocks partially offset the losses. Investors reacted to a mix of global and domestic factors, including a pullback in Wall Street, Elon Musk’s dispute with Donald Trump, and new signals from the US Federal Reserve.

ASX200 Closes Lower Amid Broader Market Caution

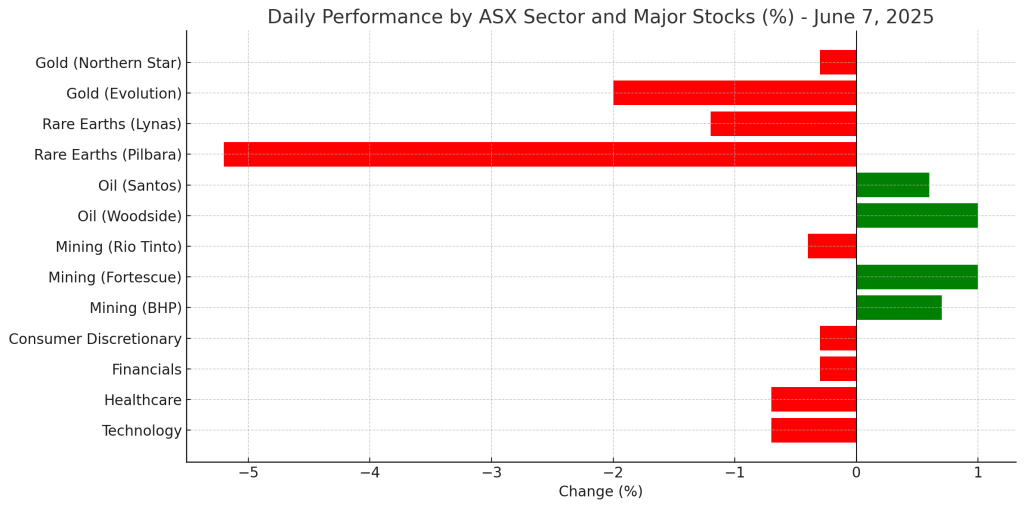

The benchmark S&P/ASX 200 Index dropped 23.2 points, or 0.3%, to close at 8515.70 on Friday, with nine of the eleven industry sectors ending in the red. The retreat follows a 0.5% drop in the US S&P 500 overnight, triggered largely by a dramatic 14.3% plunge in Tesla’s share price.

In Australia, technology and healthcare stocks were the worst performers, each declining 0.7%. Financial stocks were also down, driven by a fall in Commonwealth Bank (ASX: CBA) shares, while the Australian dollar traded at US64.97 cents during the session.

Miners Lifted by US-China Trade Progress

Mining companies offered a bright spot. BHP (ASX: BHP) rose 0.7% and Fortescue Metals (ASX: FMG) gained 1% on optimism surrounding ongoing trade talks between the US and China—Australia’s largest export market for iron ore. However, Rio Tinto (ASX: RIO) bucked the trend, dipping 0.4%.

US President Joe Biden reported a “very good phone call” with Chinese President Xi Jinping, raising hopes for a breakthrough in trade negotiations that have been tense since the Trump administration imposed wide-ranging tariffs.

Oil stocks also posted modest gains. Woodside Energy (ASX: WDS) climbed 1%, and Santos (ASX: STO) rose 0.6%.

Banking Sector Retreats from Record Highs

Commonwealth Bank, Australia’s most valuable listed company, declined by 0.8% after hitting an all-time intraday high of $182 per share on Thursday. Its market capitalisation briefly crossed the $300 billion threshold this week. CBA represents roughly 12% of the ASX200 and has surged nearly 17% year-to-date.

Other major banks were mixed. Westpac (ASX: WBC) lost 0.2%, ANZ (ASX: ANZ) dropped 0.4%, while National Australia Bank (ASX: NAB) edged 0.2% higher.

Tech and Rare Earths Hit by Market Sentiment

Technology stocks lagged behind, weighed down by negative momentum from Wall Street. WiseTech Global (ASX: WTC) fell 1%, Xero (ASX: XRO) slipped 0.7%, and data centre provider NextDC (ASX: NXT) dropped 0.9%.

Rare earth stocks fell sharply as signs of progress in US-China relations raised expectations that China could ease restrictions on exports of critical minerals. Pilbara Minerals (ASX: PLS) tumbled 5.2%, and Lynas Rare Earths (ASX: LYC) lost 1.2%.

Gold miners also saw declines, with Evolution Mining (ASX: EVN) down 2% and Northern Star Resources (ASX: NST) 0.3% lower, as global investors shifted away from safe-haven assets.

Focus Shifts to US Jobs Data and Federal Reserve

Investor attention is turning to the US non-farm payroll data for May, due Friday night (US time). Wall Street expects a slowdown in job creation from April, which could impact expectations around interest rate cuts.

Craig Sidney, a senior investment adviser at Shaw and Partners, noted: “If it’s a big number, there will be an expectation that rate cuts may be pushed back a bit further.”

The US Federal Reserve is anticipated to keep rates on hold during its June 17-18 meeting. Futures trading indicates a 25% probability of a rate cut by July, and a 90% chance by September. Two quarter-point cuts are fully priced in by the end of the year, according to CME FedWatch.

Tesla Tumbles Amid Musk-Trump Dispute

The US market was roiled by Tesla’s sharp decline, with its shares falling 14.3%—its worst single-day drop in over a year. The company has lost nearly 30% of its market value in 2025 to date, wiping out around US$150 billion, and dragging its valuation below the US$1 trillion mark.

The slide followed public spats between CEO Elon Musk and former US President Donald Trump, reportedly over differences in opinion about taxation and trade policy. This has added uncertainty around the company’s strategic direction and its perceived alignment with US industrial policy.

US Jobless Claims Rise to 8-Month High

The US Department of Labor reported that new applications for unemployment benefits rose by 8,000 to 247,000 for the week ending May 31. This is the highest level in eight months, though still historically low.

Economists see the increase as a potential early signal of labour market cooling, which would play into the Federal Reserve’s calculus on interest rate moves.

S&P 500 Nears Resistance

Despite recent gains, the S&P 500 pulled back 0.5% on Thursday, marking its first decline in four trading days. The index is now 3.3% below its all-time high, after recovering most of its losses from a 20% drop earlier this year.

Analysts attribute the rally to optimism around easing trade tensions, stabilising interest rates, and improving corporate earnings.

ASX Daily Sector Performance – June 7, 2025

| Sector/Stock | Daily Change (%) |

| Technology | -0.7 |

| Healthcare | -0.7 |

| Financials | -0.3 |

| Consumer Discretionary | -0.3 |

| Mining (BHP) | +0.7 |

| Mining (Fortescue) | +1.0 |

| Mining (Rio Tinto) | -0.4 |

| Oil (Woodside) | +1.0 |

| Oil (Santos) | +0.6 |

| Rare Earths (Pilbara) | -5.2 |

| Rare Earths (Lynas) | -1.2 |

| Gold (Evolution Mining) | -2.0 |

| Gold (Northern Star) | -0.3 |